The following is a basic guideline of information you will need to begin a business in Okaloosa County. Additional information or requirements should be addressed with the appropriate agencies.

The following is a basic guideline of information you will need to begin a business in Okaloosa County. Additional information or requirements should be addressed with the appropriate agencies.

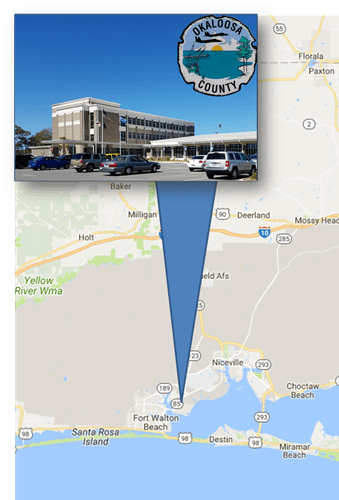

A Business Tax Receipt (formerly County Occupational License) is issued by the Tax Collector for the privilege of operating a business. Anyone providing merchandise or services to the public, even though a one-person company or home based occupation, must obtain a county business tax receipt to operate. The Business Tax Receipt fee is $35 per location, regardless of the nature of the business. The Okaloosa County Business Tax Receipt application and appropriate fee information may be obtained at www.okaloosatax.com or by visiting one of six County-Wide Okaloosa Tax Collector Locations

Before an Okaloosa County Business Tax Receipt can be obtained, a business must meet all conditions required by city, county, state or federal agency regulations which apply to that business or occupation. Many businesses will be subject to zoning codes. Information about permits or inspections can be found at www.myokaloosa.com

Do I need a permit to operate a business out of my home?

Yes, you need a home occupation permit from the Growth Management Department to operate a business out of your home. You may operate a business out of your home if you meet certain criteria that basically requires that you not change or alter the outside appearance of your home from a residence to a commercial use, no employees outside the family, all business activities are within 25% of the home and not in any detached buildings, and that traffic and noise is not beyond normal residential limits. Get the application